Multi Currency Account

Millions of people each year are managing their finances across a number of countries. This is either as a result of moving abroad, having family in another country or travelling regularly for work or play. With the rise of frictionless remote work in the wake of the pandemic, this figure is rising at a frightening pace, unravelling the need to be able to seamlessly manage your bank accounts in multiple countries.

Sign Up Today

Multi currency bank accounts are nothing new, and this is something that challenger banks have been focusing on providing to users for several years. The issue is that it simply isn't viable to manage all of your money in one of these - it's predominantly a case of risk. Having all your assets across countries operated by one service means that you are taking on a much larger level of risk than spreading it across different accounts for each foreign currency.

.png)

Domestic Currency

.png)

Alternative & Cryptocurrency

The Strabo Dashboard

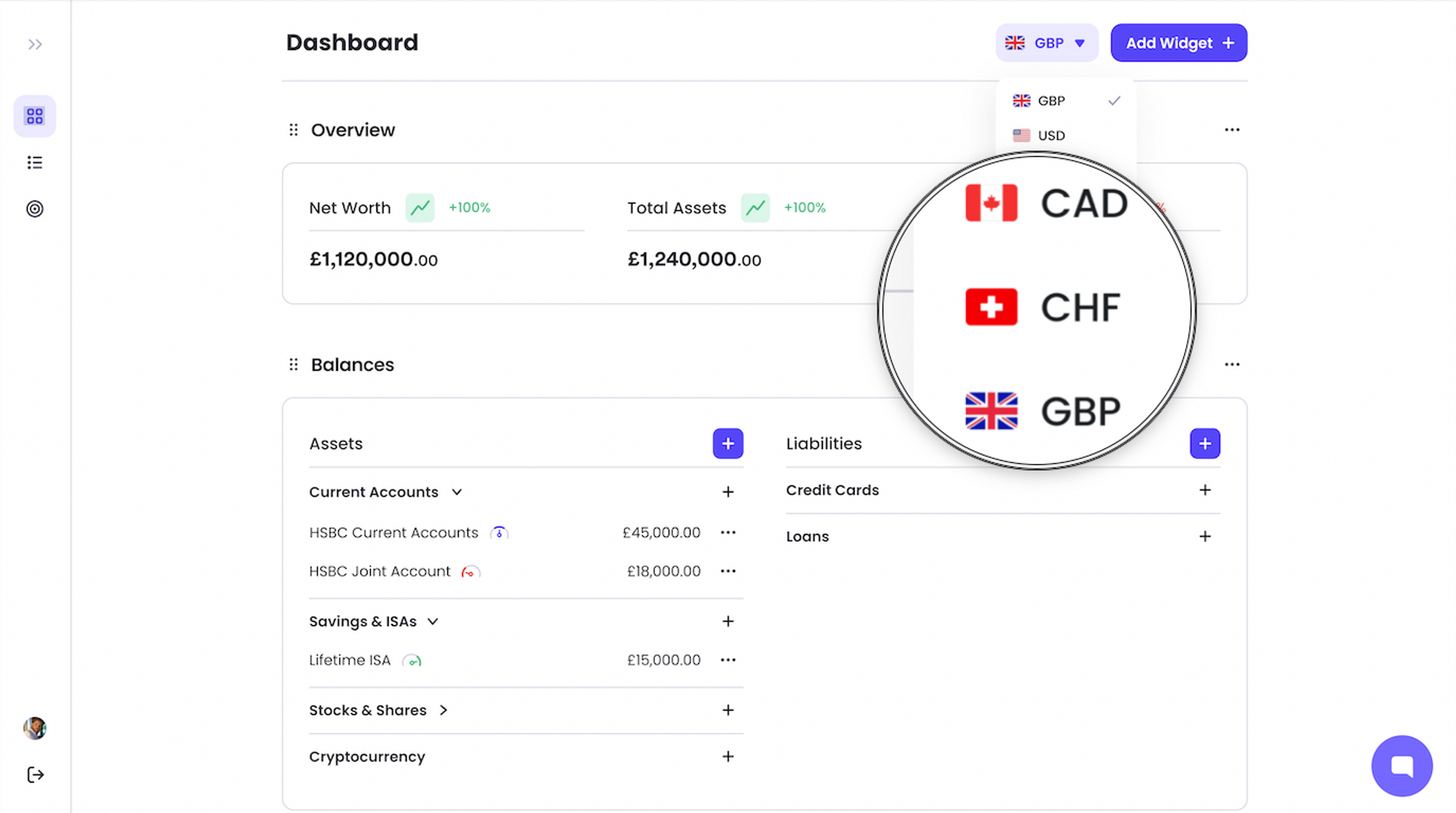

Using the Strabo dashboard allows users to simultaneously manage their accounts denominated in Dollars, Euro, Sterling and many others together, without compromising their diversification. Simply connect your existing accounts to the platform via open banking APIs, and you'll be able to see exactly what you have in each simultaneously, as well as tracking their progress over time.

This is especially pertinent to investment accounts, whose value is not static, but dependent on market performance at any given time. Allowing you to switch between display currencies at the push of a button means that you can also see the effects of fluctuating exchange rates on your portfolio as a whole.

Think of it like interactive accounting for your finances. You can even see your global balance in cryptocurrency form!

- Rather than acting as a full replacement for mobile banking and online banking, Strabo simply provides information to supplement these services.

This also comes in the form of portfolio allocation and risk analysis, which are now much less confusing in a unified currency view.

This includes not only stocks, bonds, crypto, alternatives and loans, but also real estate including domestic and rental property.

- We'll soon be releasing more detailed customisation along with a financial goal and retirement calculator, so sign up below to be the first to access this!

What our customers say about us

Sign Up Today

Frequently asked questions

Is Strabo secure?

We've gone to great lengths to ensure we prioritise your security.

Strabo Financial Ltd is authorised & regulated by the Financial Conduct Authority and based in London.

What currencies do you support?

- We currently support all major currencies, including the Dollar, Pound Sterling, Euro and more. You also have the option to choose which currency you'd like to view your balances in at any one time, and we'll remember your default one based on your signup location.

Can I make currency transfers in app?

Not yet, but it's part of the plan! We're looking at cross-currency payments as a potential future endeavour, but the regulatory and resource requirement is much larger for this so we want to get it right. For now, we're focused on building out our core services outside of foreign exchange.

Do I need to move any of my money?

You don't need to move any money, open or close any accounts or contact your back to use the product. Just log in and link them up, and we'll take care of the rest. All major banks allow partnerships using Open Banking (https://www.openbanking.org.uk/what-is-open-banking/) - you can find out more via their individual policies or by calling their customer helplines directly.

How do I know when is a good time to make a currency transfer?

Currency fluctuations can be volatile, particularly in times of geopolitical unrest. We can't give specific recommendations as to when might be a good time, but tracking your portfolio in different currencies will give you a great indication as to when one particular currency is more favourable and so when might be an ideal time to make a wire transfer. Be aware of any fee structures before making large transfers.

When investing as part of your financial planning journey, it's important to remember that the value of your holdings can go down as well as up over time. It's vital that you are comfortable with the level of risk you are taking on, and this will dictate how you allocate your resources between asset classes.

Strabo is authorised and regulated by the Financial Conduct Authority

We use cookies on this website to ensure you get the best experience, and by using the site you are consenting to them. You can manage your cookie settings via your browser settings at any time.