Future Net

Worth

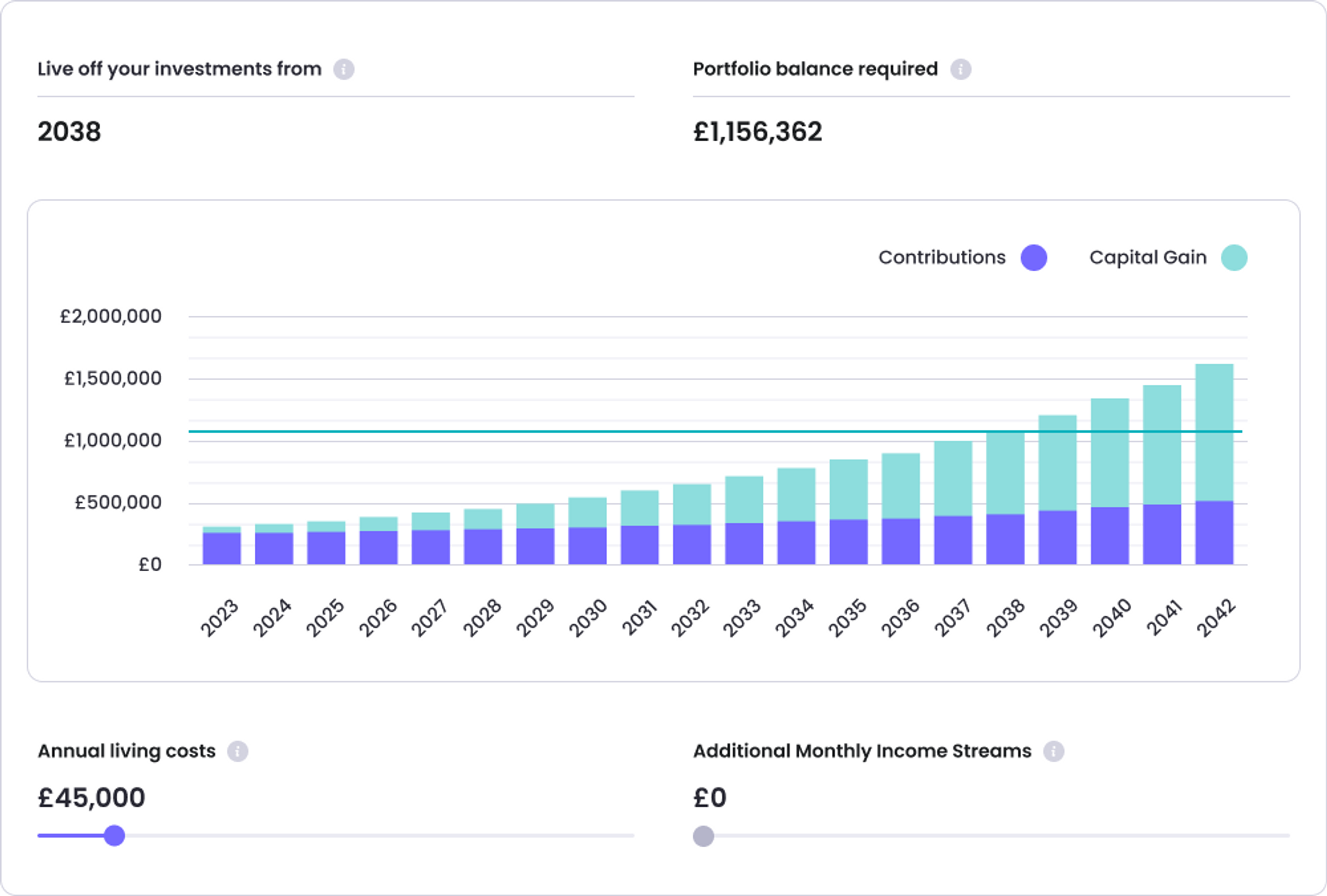

The final part of the process is forecasting. One of the most important aspect of financial planning is retirement, and part of planning for retirement is calculating how much you'll need to retire.

This is usually done by working out your estimated living expenses, and working backwards to figure out how large a pot you'll need to provide this income in perpetuity. From there, you can see how much you'll need to invest from today to reach that goal.

Sign Up Today

Of course, to work out how much you need to invest to reach your retirement (or intermediary) goal, you'll need to do some investment forecasting. This will allow you to project the growth rate that your portfolio is expected to achieve, and thus what sort of sized pot you can expect to have at the final date. Now, of course, this isn't an exact science. Estimates are, well, exactly that. Fortunately, our tools are designed to be conservative to ensure that you are left with a buffer to ensure that even if the market exhibits a period of sustained negative growth, you will still be safe over the long term.

.png)

Equities

What is your assets and liabilities snapshot at this point in time?

.png)

Bonds

What are you aiming for over the long term? Make these measureable

.png)

Real Estate

Can these be optimized? If so, how?

The Strabo Dashboard

- One of the most important features of the dashboard is the portfolio allocation display. This gives users the opportunity to observe their asset allocation: firstly to see the split between cash & short term deposits, traditional investment and alternatives, but then on a more granular level how these are broken down.

- You’ll want to see how your portfolio is split, observe performance over time and make the necessary rebalancing adjustments where required.

Of course, there are limits to what we can tell you - we’re not in the business of dishing out financial advice, but that’s ok because each person’s asset allocation should be unique to their idiosyncratic needs.

- After setting a target, you’ll be able to track progress towards it and rebalance as necessary.

This is vital - it's the action step, so we can't do it for you!

Your asset allocation will also change over time with your capacity for risk, with more or less responsibilities and less and less time until your target retirement date.

What our customers say about us

Sign Up Today

Frequently asked questions

How Can I Decide How Much to Allocate to Traditionals vs Alternatives?

This isn’t something we can recommend: it very much depends on your capacity for risk, given that risk and return are so well correlated. However, we can certainly point you in the direction of some more information, starting with our blog post on the subject.

How Do I Know Which Traditionals Are Right for Me?

- Within the subset of Traditional asset classes, it is then possible to split these further based on their risk / reward profiles, and your timeline for investing. As long as you are investing for more than 5 years or so, equities should make up a significant portion of this tranche.

Are all Stocks part of the Traditional Asset Class?

Yes. Now, there is obviously an increased risk involved in investing in fewer stocks, so you’ll want to diversify - the easiest way to do so is by investing in mutual funds, a guide for which can be found here.

How do I know when to Rebalance?

- There isn’t one right answer. But you can find this out by setting a target asset allocation based on your risk profile, and as different asset classes grow at different rates, you’ll find that you need to move capital from one to the other in order to maintain your target allocation. This is a great way of ensuring that risky assets which often exhibit outsized growth don’t become too large a portion of your portfolio.

What can I do next?

- You should start by following the steps in this guide, whether you're using the Strabo dashboard or not. We'd love to help you get started or pick up where you've left off, so jump on board or reach out to us at hello@strabo.app

When investing as part of your financial planning journey, it's important to remember that the value of your holdings can go down as well as up over time. It's vital that you are comfortable with the level of risk you are taking on, and this will dictate how you allocate your resources between asset classes.

Strabo is authorised and regulated by the Financial Conduct Authority

We use cookies on this website to ensure you get the best experience, and by using the site you are consenting to them. You can manage your cookie settings via your browser settings at any time.