Alternative

Investments

Alternative, as opposed to traditional, investments are part of a more advanced investment strategy.

1. They exhibit higher volatility than things like stocks or bonds, and as such should not make up more than a fairly small portion of a risk averse portfolio.

2. For that reason, it is important to build up a solid, risk averse portfolio before diversifying into alternatives, which are often less than perfectly correlated with the market as a whole.

3. This makes them good additions to have, particularly during market downturns, when assets that are countercyclical to the economy become more valuable.

Sign Up Today

So what does this asset class actually comprise? Well, pretty much anything other than stocks, bonds, cash, and real estate. This can include private equity or venture capital, hedge funds, futures and options and cryptocurrency. It can also include physical assets like paintings and art, as well as commodities like steel, iron and gold. The risk and return profile of each of these is idiosyncratic, which makes them the perfect vehicles for diversifying a portfolio.

.png)

Shareholdings

Pieces of companies in private markets. Private Equity & Venture Capital

.png)

Digital Assets

Cryptocurrencies & options on future values of company equity

.png)

Tangibles

Paintings and other art, and ownership of commodities

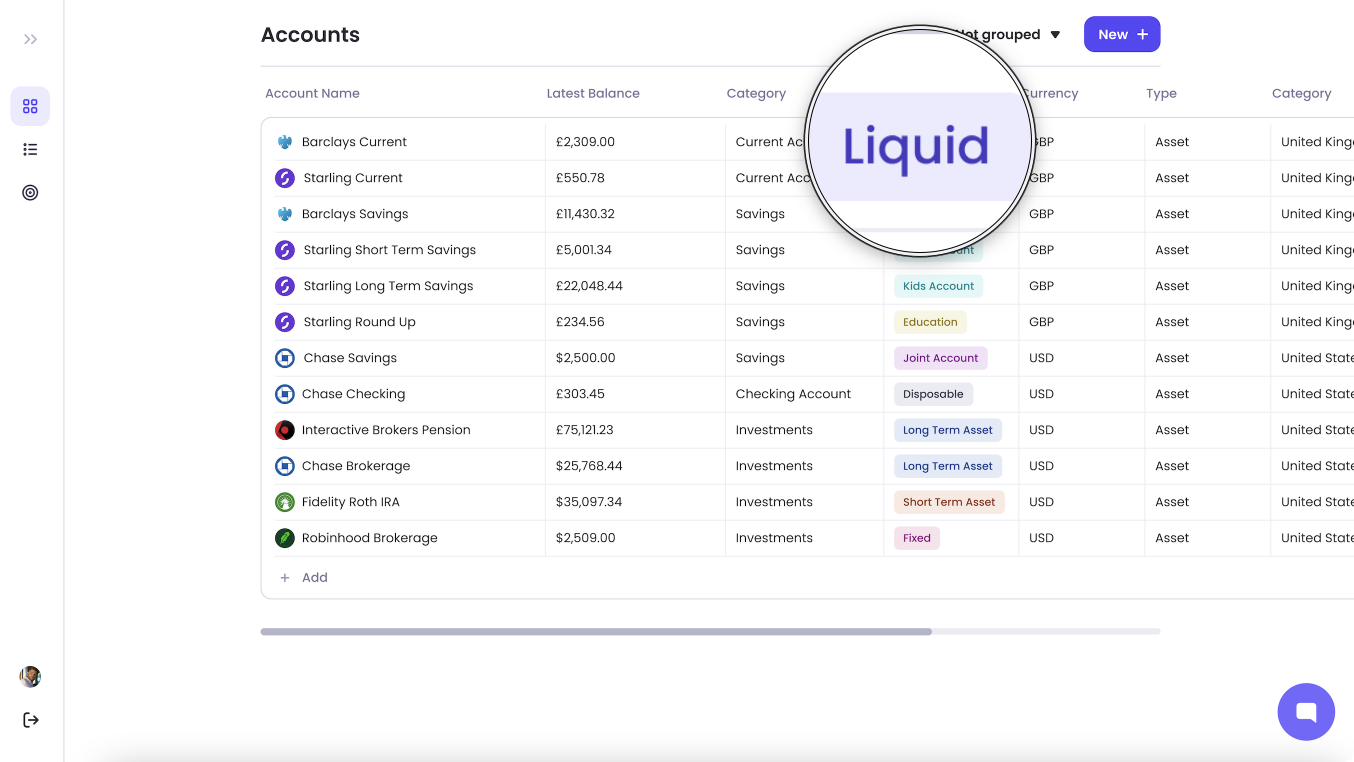

The Strabo Dashboard

- One of the most important features of the dashboard is the portfolio allocation display. This gives users the opportunity to observe their asset allocation: firstly to see the split between cash & short term deposits, traditional investment and alternatives, but then on a more granular level how these are broken down. This will help you to figure out

- You’ll want to see how your portfolio is split, observe performance over time and make the necessary rebalancing adjustments where required.

Of course, there are limits to what we can tell you - we’re not in the business of dishing out financial advice, but that’s ok because each person’s asset allocation should be unique to their idiosyncratic needs.

- After setting a target, you’ll be able to track progress towards it and rebalance as necessary.

This is vital - it's the action step, so we can't do it for you!

Your asset allocation will also change over time with your capacity for risk, with more or less responsibilities and less and less time until your target retirement date.

What our customers say about us

Sign Up Today

Frequently asked questions

How Can I Decide How Much to Allocate to Traditionals vs Alternatives?

This isn’t something we can recommend: it very much depends on your capacity for risk, given that risk and return are so well correlated. However, we can certainly point you in the direction of some more information, starting with our blog post on the subject.

How Do I Know Which Alternatives Are Right for Me?

- Within the subset of Alternative asset classes, it is then possible to split these further based on their risk / reward profiles, and your timeline for investing. As long as you are investing for the long term and not speculating, it largely comes down to personal preference.

Are all Cryptocurrencies part of the Traditional Asset Class?

Yes. Now, there is obviously an increased risk involved in investing in smaller coins, which exhibit a more aggressive risk profile - it's probably best to only put money into large caps to begin with, and ones you're comfortable about understanding.

How do I know when to Rebalance?

- There isn’t one right answer. But you can find this out by setting a target asset allocation based on your risk profile, and as different asset classes grow at different rates, you’ll find that you need to move capital from one to the other in order to maintain your target allocation. This is a great way of ensuring that risky assets which often exhibit outsized growth don’t become too large a portion of your portfolio.

What can I do next?

- You should start by following the steps in this guide, whether you're using the Strabo dashboard or not. We'd love to help you get started or pick up where you've left off, so jump on board or reach out to us at hello@strabo.app

When investing as part of your financial planning journey, it's important to remember that the value of your holdings can go down as well as up over time. It's vital that you are comfortable with the level of risk you are taking on, and this will dictate how you allocate your resources between asset classes.

Strabo is authorised and regulated by the Financial Conduct Authority

We use cookies on this website to ensure you get the best experience, and by using the site you are consenting to them. You can manage your cookie settings via your browser settings at any time.