Financial Planning

Firstly, what is it?

1. Financial Planning involves an evaluation of your current and expected financial state.

2. It's not a one-off action, but an iterative process. Using known variables you can predict future income, asset values and withdrawal plans or liquidity events, allowing you to securely and comfortably make financial decisions for the future and for your family.3. This often pertains to investment management, but also areas such as risk management, asset allocation and trajectory towards financial goals. Think of it as running your life like a business.

Sign Up Today

.png)

Current Position

What is your assets and liabilities snapshot at this point in time?

.png)

Personal Goals

What are you aiming for over the long term? Make these measureable

.png)

Financial Analysis

Can these be optimized? If so, how?

Periodic Review

A weekly/monthly and annual check-in to see how you're doing

.png)

Implement

Let's get started!

.png)

Create Plan

What steps need to be taken to do this optimization?

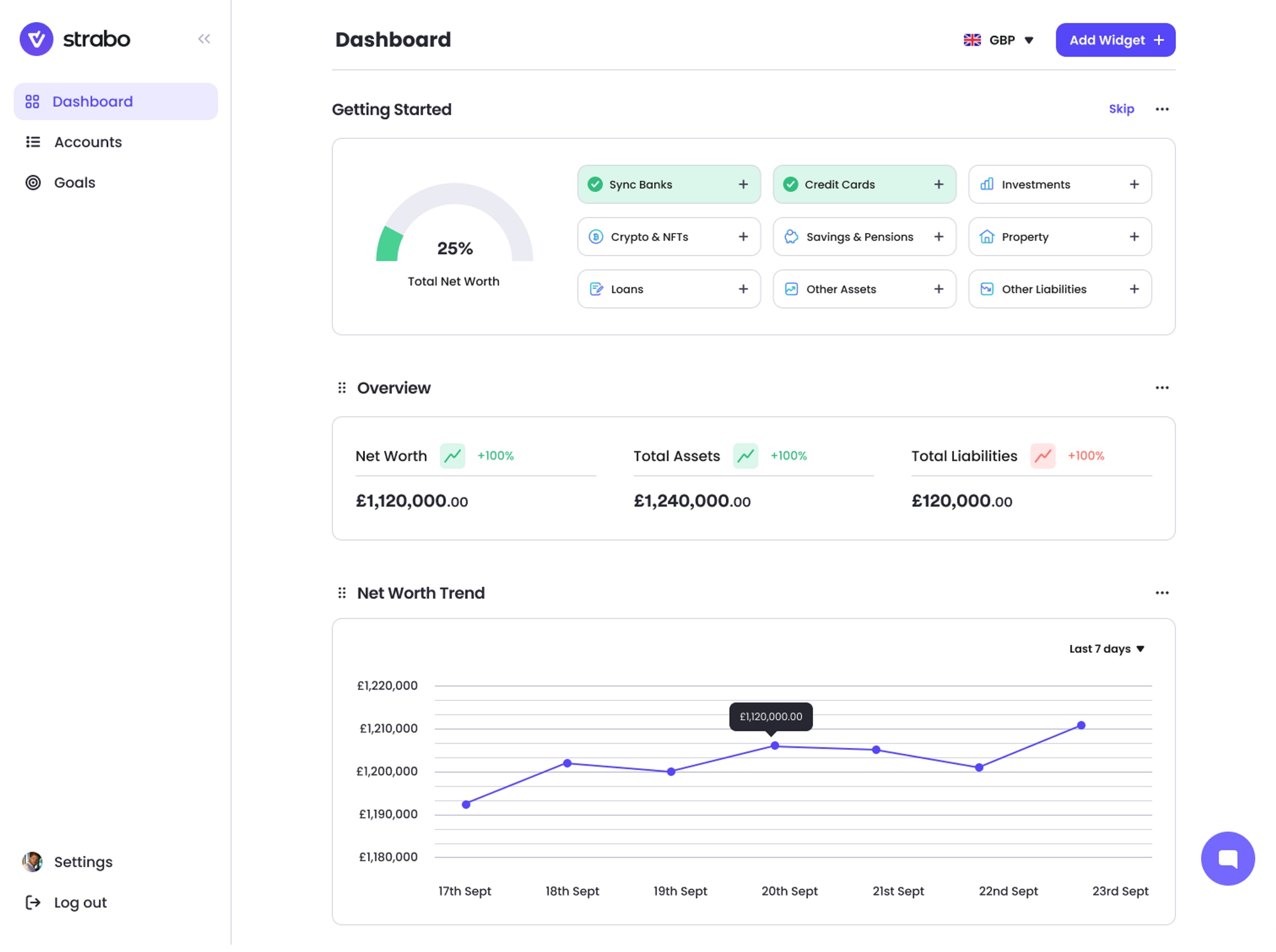

The Strabo Dashboard

- That sounds complicated, but once broken into steps it makes a lot more sense. Firstly, what are you aiming for? This might broadly be retirement, or more sooner saving up for a house or university. In fact, it might just be to keep saving and investing rates on track.

Live connections to your accounts update the values of your holdings in real time, so you can see a clear picture of your assets, liabilities and income at any one time.

- Covers all asset classes across currencies, and includes the option for custom additions too, meaning it will be abundantly clear where the gaps and opportunities for change lie.

Portfolio allocation and risk analysis mean that you will also be able to see whether your allocation matches up with your risk profile, and where to allocate new funds.

This includes not only stocks, bonds, crypto, alternatives and loans, but also real estate including domestic and rental property.

- We'll soon be releasing more detailed customisation along with a financial goal and retirement calculator, so sign up below to be the first to access this!

Now you can compile a list of what you have, both assets and liabilities, and conduct a scan to find the gaps. Are you currently on track to achieving these goals? This will give you some idea as to what changes in income, savings rate and liabilities will be required to reach your goals. Knowing this allows you to not only make plans to implement these changes, but to structure your assets in a way that is most favourable to your idiosyncratic goals: what to invest in and in what proportions.

Finally, when implementing these changes, it's important that you check in at regular predefined intervals. You'll also then be able to project how much tax might be payable on both your income and portfolio, and work out how best to take advantage of tax regulation to pay the right amount. When in doubt, always seek the advice of an accountant.

What our customers say about us

Sign Up Today

Frequently asked questions

Does Strabo provide Financial Planning Advice?

- No. We provide you with the information to allow you to make more informed individual decisions. For formal help, please seek out professional financial advice from an expert. You can use your dashboard as a starting point to work from for this

Isn't Financial Planning just for the Wealthy?

- This is a common misconception. In fact, creating a good financial plan is most important when you aren't wealthy. It's an ongoing process that will allow you to reduce your money stresses, meet your current needs and help to build a nest-egg to fund your long term goals.

Will a Paid Service actually help me save money?

Great question! In a word, yes. One single change in portfolio allocation, nudge to use your ISA allowance on time or risk warning about a change in your portfolio allocation could be worth anything from hundreds to thousands of pounds over the course of a year.

Add to that the time saved collecting and analysing the information to make financial decisions, and the peace of mind knowing where you are at any one time, all of the time, and it starts to make sense. If you're still unsure, try our free trial or reach out to a member of the team at hello@strabo.app

When is the Right Time to Start?

- The best time to start is always now! The impacts of effective financial planning will be more profound the earlier you start, so there's no time to waste. Get started with our guide and stay in touch for future updates by signing up above

What can I do next?

- You should start by following the steps in this guide, whether you're using the Strabo dashboard or not. We'd love to help you get started or pick up where you've left off, so jump on board or reach out to us at hello@strabo.app

When investing as part of your financial planning journey, it's important to remember that the value of your holdings can go down as well as up over time. It's vital for consumer awareness in any investment that you are comfortable with the level of risk you are taking on, and this will dictate how you allocate your resources among asset classes.

Note that even several years of bad performance do not determine the long-term outlook for your holdings, and wider market conditions have adverse effects on investments. You can read more about structuring your portfolio here, and about investing in a down market here. Strabo is authorised and regulated by the Financial Conduct Authority

We use cookies on this website to ensure you get the best experience, and by using the site you are consenting to them. You can manage your cookie settings via your browser settings at any time.