Investment

Performance

Why do we invest? Well, the simple answer is that we want to see a return on our savings that exceeds the rate of inflation, in order to grow our pot. At the very least, we'd expect to exceed the rate of return available from saving our money in a deposit account. This should be, although isn't always, commensurate with the amount of risk that has been taken, in order to adequately compensate us.

Sign Up Today

Different investments have different profiles and as such, can provide different levels of risk and return, which are at least somewhat correlated. If you are taking on a larger than normal level of risk, it is expected that you will be rewarded with a higher return over the long run. That being said, given that riskier assets exhibit higher volatility in the short run, it is not usually sensible to construct a portfolio solely of risky assets. So the question is, how do we track performance?

.png)

Time Horizon

What is the period of time over which you are making this investment? How risky is it?

.png)

Annual Return

What is the % return over the given time period, or how much of it has elapsed so far

.png)

Benchmark

How does this compare to the market average? Are you being adequately compensated?

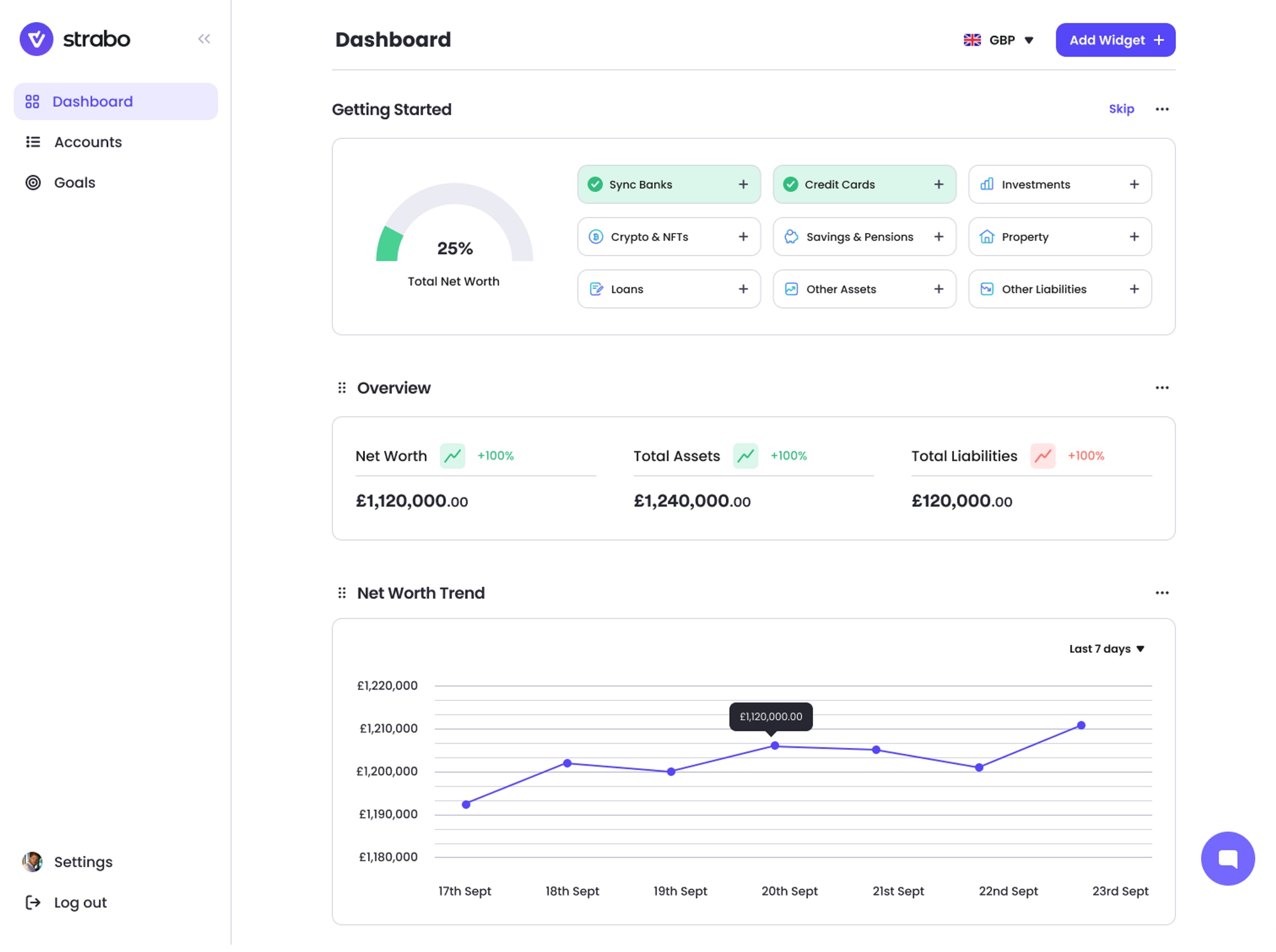

The Strabo Dashboard

- One of the biggest challenges of managing a portfolio yourself is tracking performance. We often have several accounts just for stocks, let alone crypto, bonds and alternatives, and tracking the returns month on month of the portfolio as a whole requires constant monitoring, logging in and out of accounts, and the construction and management of a spreadsheet.

- With Strabo, your performance is monitored automatically. Valuations are updated in real time, and with access to all historical performance data, we'll be able to tell you exactly how well your portfolio and individual holdings are performing.

Looking back at past performance of the assets you hold allows us to both track returns against these, and forecast future investment performance.

- You'll be able to set targets and thresholds, track progress towards them and measure the risk that you're taking along the way. This means that you can always be sure you've chosen the correct portfolio for you.

By closely tracking performance, you'll be able to see when your portfolio allocations and risk factors change, meaning you can rebalance your portfolio immediately using our tools.

What our customers say about us

Sign Up Today

Frequently asked questions

What measures do you use to track performance?

Asset performance is tracked using % return. This is aggregated and weighted across your holdings to provide a portfolio return over a specified time period.

How do I know if my portfolio performance is good enough?

- As you might imagine, good enough is completely subjective. However, we'll compare your performance to the market as a whole, to your preset goals, and the expected return for the level of risk you're taking.

Can you track the performance of everything?

For things like stocks, bonds, cryptocurrency and commodities, there are liquid markets so it's very easy to track real time values using available information. However, for less liquid asset classes like real estate, private investments and venture capital, valuations occur infrequently. For these, we'll either make an estimation based on available data, or let you manually input a value yourself.

How do I know when to Rebalance?

- There isn’t one right answer. But you can find this out by setting a target asset allocation based on your risk profile, and as different asset classes grow at different rates, you’ll find that you need to move capital from one to the other in order to maintain your target allocation. This is a great way of ensuring that risky assets which often exhibit outsized growth don’t become too large a portion of your portfolio.

What can I do next?

- You should start by following the steps in this guide, whether you're using the Strabo dashboard or not. We'd love to help you get started or pick up where you've left off, so jump on board or reach out to us at hello@strabo.app

When investing as part of your financial planning journey, it's important to remember that the value of your holdings can go down as well as up over time. It's vital that you are comfortable with the level of risk you are taking on, and this will dictate how you allocate your resources between asset classes.

Strabo is authorised and regulated by the Financial Conduct Authority

We use cookies on this website to ensure you get the best experience, and by using the site you are consenting to them. You can manage your cookie settings via your browser settings at any time.