The World's Best

Portfolio Tracker

A customisable investment dashboard to manage your assets around the world

- Join a waitlist of 2,000+ others

.svg)

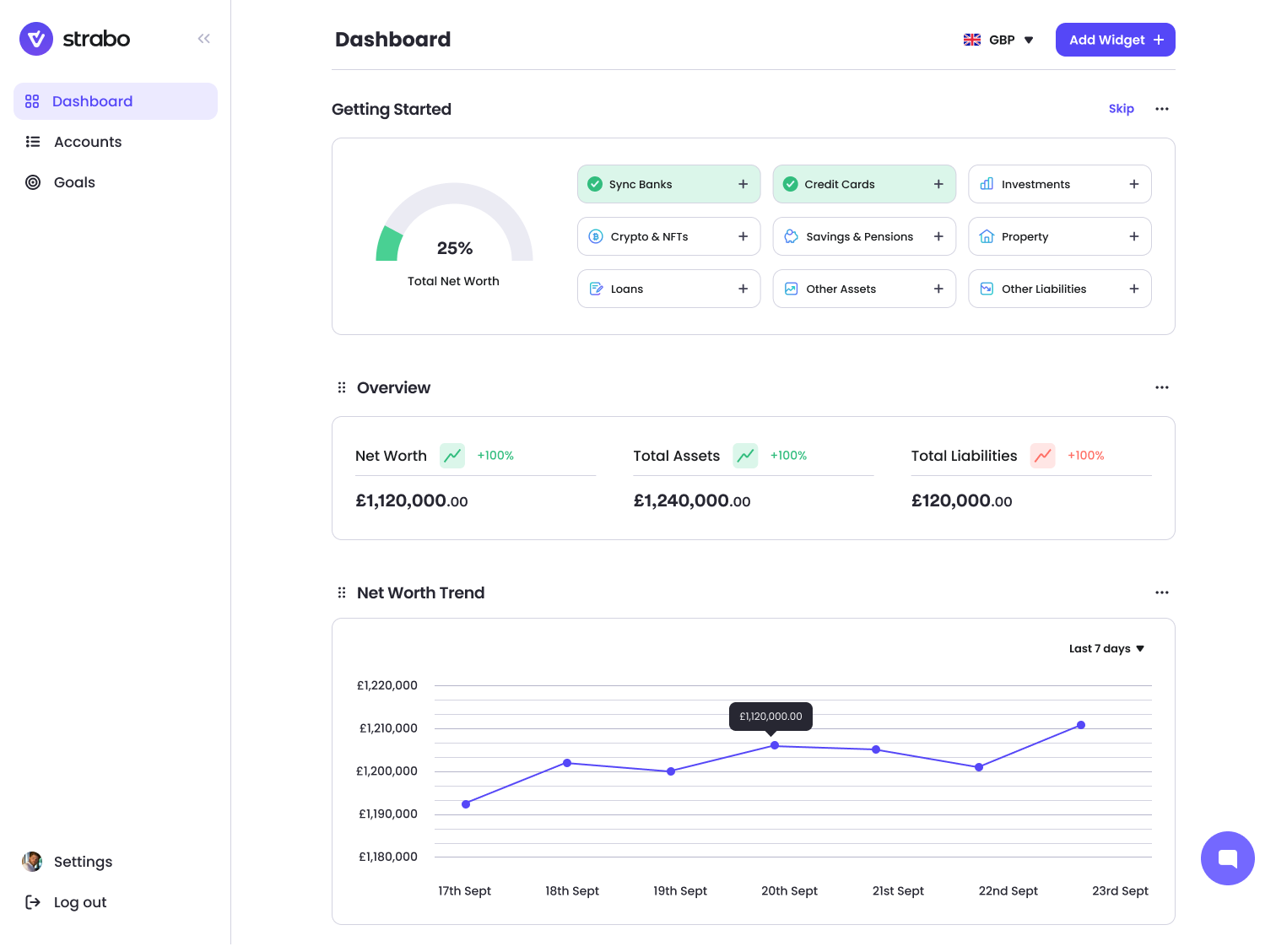

All Assets on one Dashboard

Add accounts to sync automatically via secure API connection or input values manually .

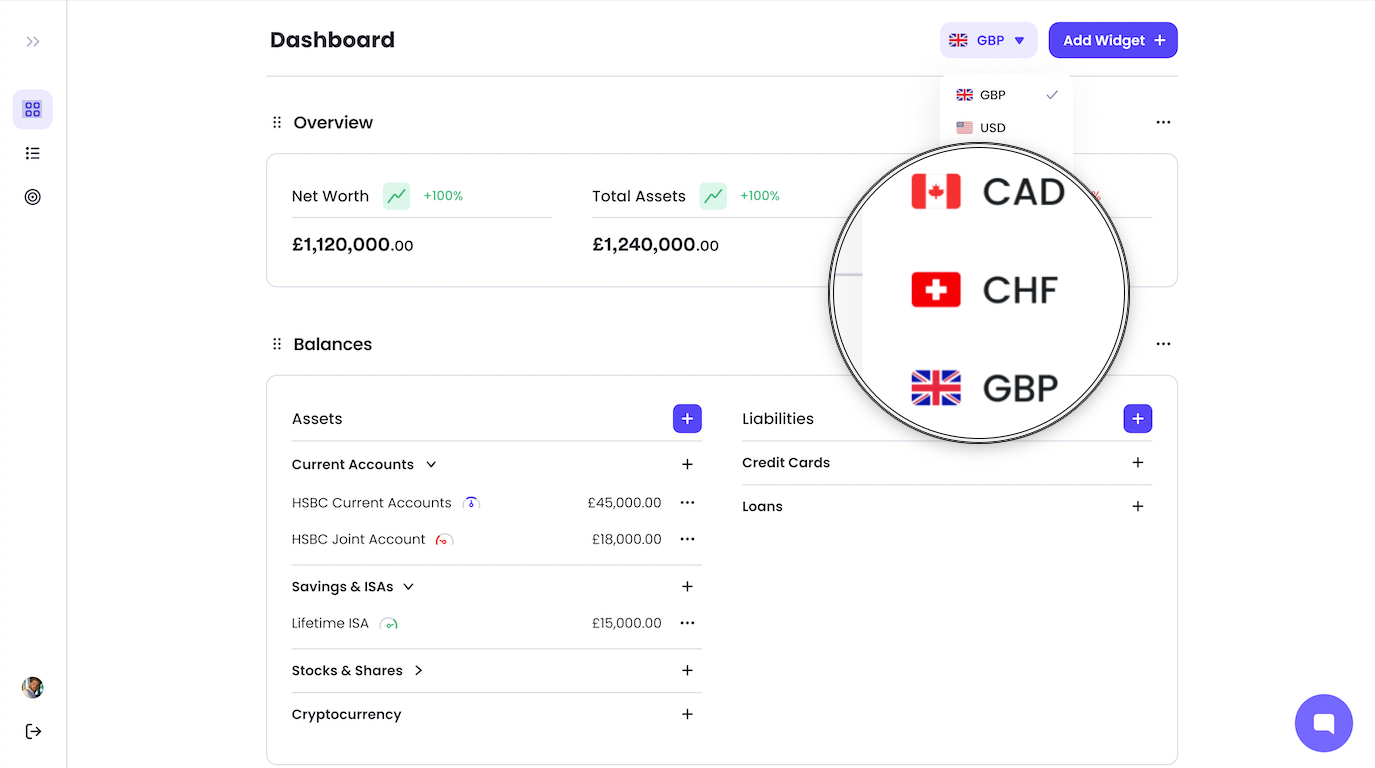

Multi Currency Tracking

- Access international accounts from 12 countries, filter your portfolio tracker by all major currencies and break your assets and liabilities down by currency denomination

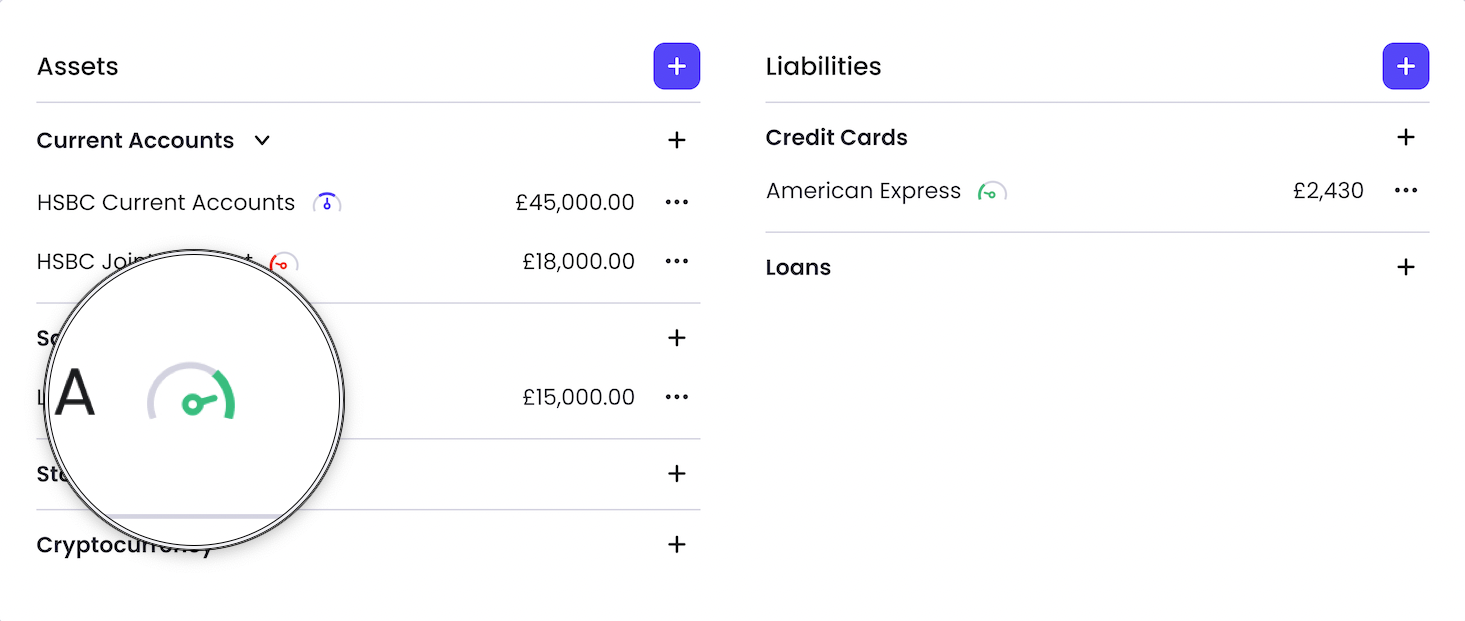

Financial Health Monitor

Break your portfolio holdings down by asset class and use preset thresholds to unearth the drivers (and drags on) your net worth, giving you the big picture with smart alerts and real time price data

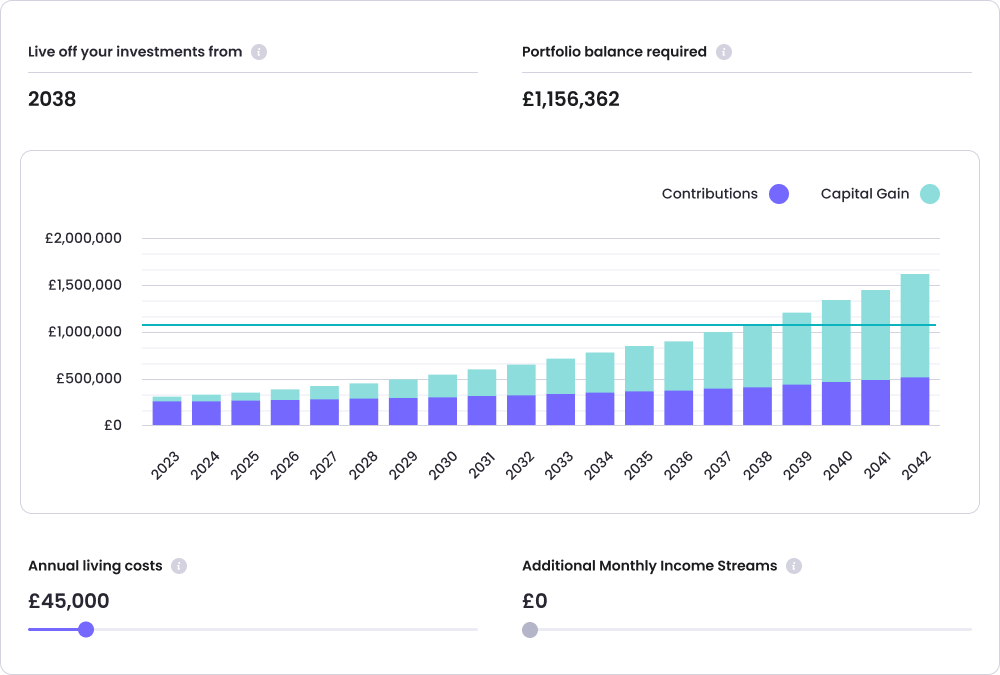

Financial Independence Calculator

Set up goals depending on your idiosyncratic needs and monitor progress towards them. Tag accounts to link them to goals and use your portfolio tracker to monitor progress towards retirement, a house or a fund for your children's education

Account Tagging & Organisation

- Allocate your all financial and investment accounts into categories with custom tags so you can automatically track progress towards goals and group all your assets into buckets, each of which can be analysed individually on your portfolio tracker.

By Alicia Adamcyzk

November 10, 2022

By Gabrielle Olya

October 3, 2022

Our ears are burning 🐦

FAQs 🙋🏻♂️

What do you do with my data?

- Strabo's policy is to never retain, store or sell any of our data. We don't run ads in platform either, and all marketing is optional and opt-in, down to the cookie data on our website

What countries are we expanding to?

Today, Strabo connects accounts from the following countries: UK, CAN, USA, IRE, NED, SP, FR, NZ, and AUS. We expect to move next to India and the Middle East

Why did you start Strabo?

After spending time building ever more complicated portfolio tracker spreadsheets on Excel with static information, we decided that more powerful professional grade analytics shouldn't be out of reach of everyday investors managing personal capital.

Is Strabo just for internationals?

- We're often asked this. The answer is no! Although we have coverage across the world, the platform is a software service provider designed to be accessible to anyone with multiple portfolios, accounts & assets, no matter your portfolio quality.

What features are coming next?

Expect deeper analytics on all your investments, asset allocation, tax insights, in app FX & more this year! A mobile portfolio tracker app is also coming soon, although the platform is responsive on your mobile device now.

Do you analyse user financial transaction information?

We appreciate that transaction data on your financial accounts is an important aspect of personal finance, and features for these will be coming soon to your portfolio tracker. This will also extend to your investment portfolio.

Get updates on Product, Team News, Community and Coverage by signing up to our Newsletter

If you would like to find out more about Strabo's permissions, regulatory status, or if you have any other questions, please reach out to us via the in-platform chat on the Strabo dashboard, or directly at hello@strabo.app. In the UK, Strabo Financial Ltd is an agent of Plaid Financial Ltd, who provide Account Information Services. They are an authorised payment institution regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 (Firm registration number 804718) for the provision of payment services, including account information services.

Strabo Financial Ltd. will never dispense financial advice and the use of any of the company's portfolio monitoring, investment performance, asset allocation or tax reporting tools should be treated with this in mind. As a registered user of the investment portfolio tracker, the status of both your individual holdings, personal capital and any subsequent financial decisions are your own responsibility. When in doubt, you should consult a registered professional for advisory services.

Past performance is not indicative of future returns and any financial information displayed on your dashboard is only completely indicative of your financial situation and the status of all your investments at one singular point in time. Your asset allocation should be reflective of your capacity and appetite for risk at all times, and as a tool to keep track and make better financial decisions. Your allocation in each asset class should also be representative of that risk profile, whether this be stocks, crypto wallets, mutual funds or exchange accounts.

We use cookies on this website to ensure you get the best experience, and by using the site you are consenting to them. You can manage your cookie settings via your browser settings at any time.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)